It is not surprising about the pervasiveness of mobile devices that mobile payment solutions are becoming more widely used internationally, spurring an increase in noncash transactions. Thousands of new applications enter the market every day, but only a select handful achieve the success they want. Therefore, it is always a good idea to delve into the app market with the kind of applications that are in high demand at the time.

The number of applications mushrooming in the app stores every day is a sign of the expansion of international mobile payment services. Fintech applications, for instance, are popular right now as consumers appreciate the simplicity of rapid money transfers, simple bill payments, and other features. Payment apps like Zain Cash, which have attracted considerable attention since their introduction in Iraq and other MENA countries, have benefited even more from this trend.

What is Zain Cash, and How Does it Work?

Zain Cash has become one of the largest and most extensively used online payment solutions in the MENA area among all today’s applications. It is a mobile cash disbursement business that Ahmed Al-Hemyari created in 2013. Zain Cash, with its main office in Baghdad, is authorized by the Iraqi Central Bank. Zain Cash, which has more than 4000 agents throughout Iraq, has a sizable user base that enables people to send and receive money, pay bills, buy online, and use other personal financial services.

Zain Cash has become one of the largest and most extensively used online payment solutions in the MENA area among all today’s applications. It is a mobile cash disbursement business that Ahmed Al-Hemyari created in 2013. Zain Cash, with its main office in Baghdad, is authorized by the Iraqi Central Bank. Zain Cash, which has more than 4000 agents throughout Iraq, has a sizable user base that enables people to send and receive money, pay bills, buy online, and use other personal financial services.

This service makes it simple for users to transfer money to their roommates, divide travel expenses, reimburse pals for lunch, or do other money-sending chores while their housemates are also using the Cash app.

How do Payment Apps like Zain Cash Work?

They must then download the Zain Cash app to their smartphones, register, and link the app to a minimum of one bank account before they may use it. You may transfer funds from the Zain Cash app account into the user’s bank account as well as to other Zain Cash app users.

The user must launch the app, input the payment amount, and then press “Pay” to submit payment. When finished, press “Pay” on the Fintech app after entering a phone number, email address, or another user’s username and the reason for the payment. The money is transferred.

Tap the “Activity” button to examine “received payment information,” and the “My Cash” button, which continuously updates the total amount deposited, will show the money placed in the app account. For direct paycheck transfer into the app account, paperwork must also be completed.

Market Trends for Payment Apps like Zain Cash

By 2025, the value of mobile payment adoption is predicted to be 4.8 billion, and this will result in significant growth for the leading companies in major worldwide areas. This is because the majority of these applications are now connected with other financial services. Google Pay, Apple Pay, PayPal, Venmo, Zelle, Cash App, PayPal, Zain Cash, and other services are the most widely used mobile payment apps in the globe. According to recent data, there will be 1.31 billion mobile payment users worldwide by 2023, demonstrating the growing acceptance and use of mobile payment apps globally.

Why are Apps like Zain Cash Popular?

For Basic Services, It’s Free

The software doesn’t charge for the most basic functions, like sending or receiving money, or for inactivity or international transaction costs. This makes the software very popular with its users.

Provides a Free, Optional Debit Card.

To manage your finances, a user can’t use the card for a personal bank account or another debit card. It is only available through the Zain Cash App.

Save Cash With Special Offers

Users of the app can choose a specific boost for their account to enable them to save money when purchasing from a certain vendor, such as receiving a discount coupon while making a buy from DoorDash.

Earn Bonus Money for Referrals

Users of the app earn a cash incentive of $5 for each person they suggest who signs up for the Cash App using their referral code, which they then share with their friends.

Easy Investment Options

The software gives users the option to invest any amount they choose—small or large—into buying stocks in particular firms. For instance, if users don’t have enough money in their Zain Cash App account to purchase the stocks, the remaining money will be deducted from the user’s associated bank account.

The Application Supports Crypto

Users of the apps like Zain Cash may purchase and sell bitcoin, but there are two types of costs associated with doing so: first, service fees for each transaction, and second, a market activity fee based on the price fluctuation on U.S. exchanges.

Core Features to Build a Payment App Like Zain Cash

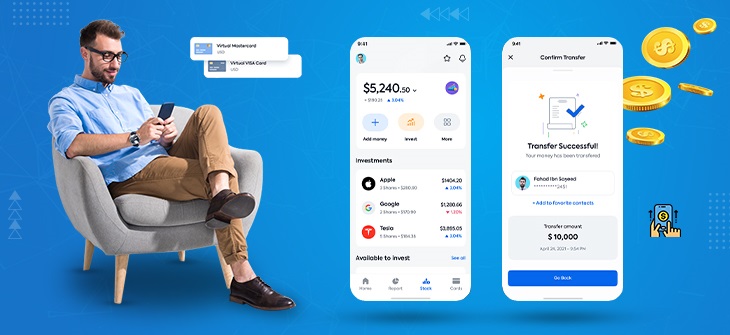

The creation of digital wallet apps heavily relies on features. You may improve the likelihood that your app will be adopted and effectively used by your target audience by using the greatest mobile payment app features. Here is a list of crucial characteristics that can set it apart from the competition.

E-Wallet

Any payment app’s main feature is its digital wallet. Users may easily make payments and save their digital money with the use of a digital wallet. Since MasterCard and Visa serve the majority of the nation’s banks, these wallets frequently incorporate their payment card tokenization services.

Fund Transfer

The two essential functions of asking and transferring money to other users are available to P2P app users. Implementing this essential function into your app will help you build a strong payment gateway and provide your users with the ability to process transactions quickly and securely.

Exchange of currencies

One of the most practical features that may increase the popularity of your mobile payment app is automatic currency conversion. Your users will be able to conduct cross-border transactions and pay for products and services while visiting other countries thanks to the deployment of this feature.

Send bills and Invoices

Your app should have the capability to generate bills or invoices that may be received by both the sender and the receiver for the convenience of your users. The bill creation function ought to be compatible with well-liked file types including PDF and in-app downloads. Additionally, users should be able to easily share the created bills and invoices.

Special ID

Your users should be able to authenticate the Unique Identification Number or One-Time Password (OTP) while conducting a transaction to prevent fraudulent or unintended transactions.

History

Implementing the transaction history feature will make it easier for your end customers to manage their accounts and balance their inflows and outflows. Give your users as much access to their account information as you can.

Account Transfer through Banks

Offer your customers the option of money transfers from applications like Zain Cash to their bank accounts and vice versa to make your peer-to-peer payment system more practical and easy.

Notifications

You will be able to quickly inform your users of promotions, new deals, or other updates by using the push notification tool. Additionally, users will be able to get alerts or instant messaging when they complete any type of transaction.

Fingerprint Lock Security

Your users can set the fingerprint security lock to the desired settings to reduce the risk connected with your application. Your users will own their accounts exclusively in this fashion.

Chatbot

Users can utilize a chatbot to swiftly resolve problems that may occur as a result of erroneous wallet debits, questions about money transfers, and other difficulties.

Crypto Payment Suport

Banking applications are evolving into a comprehensive platform for processing payments in cryptocurrencies and other digital currencies like Ethereum and Bitcoin.

Tech Stack to Build a Payment App like Zing App

Based on the kind of your app, you must select a robust collection of technologies to create an app similar to Zain Cash. The future of your product depends on your choice of technology because it affects the application’s performance as a whole.

Application and Data

JavaScript, Java, MySQL, Redis, Amazon EC2, Sass, Firebase, Ruby, Android SDK, Kafka, Swift, Hadoop, D3.js, Airflow, Ember.js, Snowflake, Vertica

Utilities

Google Maps, Looker, Retrofit, HackerOne

DevOps

Jenkins, IntelliJ IDEA, New Relic, TestFlight, Bugsnag, Crashlytics, PagerDuty, Bazel, QUint, Buck

Business Tools

Slack, Jira

Cost To Develop A Payment App Service Like A Cash App

The number of features and functionalities in the app, the number of developers put in, the hours worked, the demography of the app development company, the technologies used, the number of platforms (iOS, Android, or both), the features of the admin panel, and the requirements for the backend.

If the app is being developed for a single platform with limited functionality, the cost might range from $25000 to $30000. This cost estimate is based on the consideration of these criteria. Additionally, the price increases and may reach $50000 to $60000 when the program is being developed for many platforms and has complex functionality.

Final Words

Make sure your payment software is dependable and interesting if you want it to have a large user base like Zain Cash.

A variety of variables, like the size and complexity of the app, the location of the development team, and the particular features and functionality needed, will affect the price to design a money transfer app like Zain Cash App.

However, you may make a profitable payment app at a fair price by working with the proper development team and meticulously arranging your app’s features and budget. The best fintech app development company creates a mobile payment app that is fully encrypted, safe, and generates substantial money for you.